are hoa fees tax deductible in california

A few common circumstances. If you never occupy any part of your rental property yourself all of your HOA fees are tax-deductible.

Are Hoa Fees Tax Deductible Clark Simson Miller

The short answer is.

. Generally HOA dues are not tax deductible if you use your property as a home year-round. In the rules of business expense tax exemptions HOA fees count. No they are not tax-deductible when used as a residence.

May 31 2019 948 PM. For example if you occupy the home for 10 percent of the year you. Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences.

However there are special cases such as when the home is rented out or used only part-time. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Are HOA fees tax deductible.

HOA fees are required from all homeowners. As a general rule most HOA fees are not tax-deductible. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house.

If youre looking for an experienced HOA management company APS Management can help. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

If you are self-employed and work primarily in your home you can deduct a part of your HOA fee through your home office deductions. Are HOA Fees Deductible. However if the home is a rental property HOA fees do become.

Penalties for Non-Payment of HOA Fees. The amount deducted corresponds with the size of your home office. Are homeowners association fees tax deductible.

However if you live in the property yourself for some of the year such as in the case of a vacation property you can only deduct fees according to the percentage of time the house is a rental property. You may be wondering whether this fee is tax deductible. Additionally if you use the home as your primary residence your HOA fee wont be tax deductible unless you work from home or run a.

It depends but usually no. However you might not be able to deduct an HOA fee that covers a special assessment for improvements. Once you figure out the percentage youll use that number to deduct your HOA fees.

In general homeowners association HOA fees arent deductible on your federal tax return. Mark the post that answers your question by clicking on Mark as Best Answer. At least the regular HOA dues do.

If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. Year-round residency in your property means HOA fees are not deductible. HOA fees on personal residence - not deductible.

It provides for the rental business and expenses related to the basic upkeep of rental homes are business expenses. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. If you purchase property as your primary residence and you are required to pay monthly quarterly or yearly HOA fees you cannot deduct the HOA fees from your taxes. Yet if the homeowner rents the unit to another family then HOA fees are deductible as a business expense during the rental period.

Therefore if you use the home exclusively as a rental property you. But there are some exceptions. Deduct as a common business expense for your rental.

Say Thanks by clicking the thumb icon in a post. HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. For first-time homebuyers your HOA fees are almost never tax deductible.

Are HOA Fees Tax Deductible. In general you cannot deduct HOA fees from your taxes if the property is your primary residence. HOA accounting can be complex and confusing.

Monthly HOA fees are tax-deductible when the HOA home is a rental house. It is not tax-deductible if the home is your primary residence. Yes HOA fees are deductible for home offices.

If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. It is important to remember that according to 2018s Tax Cuts and Jobs Act this deduction is only allowable for those who are self-employed. There may be exceptions however if you rent the home or have a home office.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. However there are a few exceptions.

You can also deduct 10 of your HOA fees. You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year. The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation.

There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual.

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Hoa Management Company Charlotte Nc

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Experian

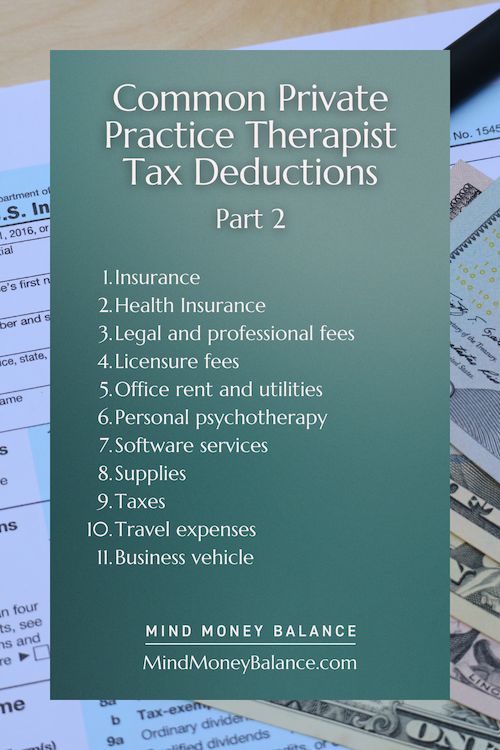

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Can I Write Off Hoa Fees On My Taxes

Can I Write Off Hoa Fees On My Taxes

Are Hoa Fees Tax Deductible Here S What You Need To Know

Requirements For Tax Exemption Tax Exempt Organizations

Are Hoa Fees Tax Deductible Here S What You Need To Know

How Is Rental Income Taxed Real Estate Tax Strategy Wealthfit

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

Closing Costs That Are And Aren T Tax Deductible Lendingtree

How Much Tax Do You Pay When You Sell Your House In California Property Escape

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)